Which Payment Providers should I use for my SaaS Product?

Published: July 13, 2023

16 min read

In this article, you'll learn:

1

💰 What is Payment Integration for SaaS?

2

⚖️ Payment Gateway vs Payment Processor

3

🤔 How to Choose a SaaS Payment Gateway?

4

💳 Stripe

5

💳 Braintree

6

💳 PayPal

7

💳 Mangopay

8

💳 Sofort

9

🧐 Comparison Of Popular Payment Gateway Providers for SaaS

10

🧑💻 How to integrate a Payment Gateway

11

📚Case Study

12

👂 Takeaways

💰 What is Payment Integration for SaaS?

Payment integration for SaaS is the process of integrating payment systems or gateways into your software product, allowing clients to make safe and practical payments for the services they use. It requires integrating the infrastructure of the selected payment provider with the SaaS platform to enable smooth transaction processing and revenue collection.

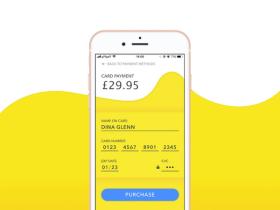

Customers pay for access to your product or service over a predetermined time, often monthly or yearly, if you run a software business that provides SaaS services. You must choose a method to make these transactions possible if you want to profit from SaaS payments. Setting up your own payment gateway is a possibility, but many businesses choose to collaborate with a third-party payment processor that manages credit card payments on their behalf.

Simple: clients make an online purchase, pay you, and your selected SaaS payment system processes the payment, taking care of everything from billing their credit card to sending the cash to your bank account.

To subscribe to your SaaS product, the client and his data go through three main stages:

- The customer chooses a plan and a payment method;

- Collecting payment information to make a payment;

- Maintaining a subscription in order to charge a fee every month.

Each of these stages is a separate system. Let's look at them in more detail.

1. Payment Gateway

Your clients may transmit their payment information securely using a payment gateway. The payment gateway notifies the customer's bank that "this is how much we need to charge" when they submit their credit card and billing information.

For example, payment gateways are PayPal and Stripe. We will talk about them in more detail below in the article. Continue reading!

2. Merchant Account

Businesses may accept and process credit card payments using a merchant account, a special type of bank account. Before being transferred to the merchant's bank account, the money from a customer's purchase is first put into the merchant account. Establishing merchant accounts with acquiring banks or payment processors is routine.

3. Subscription Management

This is the process of managing recurring payments and subscriptions for SaaS products. This includes dealing with subscriber registrations, renewals, upgrades, downgrades, cancellations, and billing cycles.

This is where Recurly can help you - this is an example of a subscription management tool for SaaS.

⚖️ Payment Gateway vs Payment Processor

There are two key players responsible for making your customer's online payment smooth and secure: the payment gateway and the payment processor. Some people think that these two terms are essentially the same, but they are not. They are individual components of the payment ecosystem. Let's figure it out!

From the previous section, you already have some knowledge about the payment gateway. It acts as a virtual bridge between the buyer, seller and financial institution. Its main function is to securely transmit payment information during an online transaction.

For example, when a customer makes a purchase on a website or app, the payment gateway encrypts and securely transmits sensitive payment data, such as credit card information, to the payment processor.

🤔 How to Choose a SaaS Payment Gateway?

In this section, we want to consider the main criteria for choosing the right payment gateway for your SaaS products.

Security & Compliance 🔒

Make sure that the payment provider has a valid PCI DSS compliance certificate, and acquaint yourself with their security procedures and resources before selecting them.

When it comes to online payments, employing payment providers increases the danger of fraud and data leakage. Choose SaaS payment solutions that adhere to the strictest data security regulations, such as the Payment Card Security Standard (PCI DSS), in order to secure the sensitive data of your clients.

Payment Options Available 🌐

Payment methods should be as diverse and convenient as possible for your client. Therefore, it’s important to choose a payment gateway that supports a wide range of payment methods, including major credit and debit cards, popular digital wallets such as PayPal, Apple Pay or Google Pay.

The more options you integrate into your website, the more likely customers are to sign up.

Fees & Recurring Payments 💸

The payment gateway charges a fee for the payment transaction. Find out in advance how much this fee is on different payment gateways, compare different options and consider the expected volume of transactions to make sure the prices fit your budget.

Recurring billing refers to the process of regularly charging customers for payments on a predetermined schedule. This payment scenario doesn’t require the direct participation of the payer and the re-entry of payment data. Being set up once, recurring payments are made automatically, without the obligatory confirmation from the payer.

💳 Stripe

Stripe, a major financial services provider, was established in 2010. It has a wide range of capabilities and is made for online shopping. Amazon, Google, Lyft, Pinterest, and Slack are a few of its customers. For these businesses, Stripe can manage huge transaction volumes. The finest platform for payment technologies for developers is Stripe. Web developers may include payment processing into their websites and mobile apps using its APIs.

Integration

Stripe offers integration possibilities for numerous platforms and development environments. Because of that, it should be quite easy for your development team to integrate Stripe into your Android, iOS, Web, or React Native apps. Here, we've gathered some of the relevant links for you:

- Android: Stripe Android SDK

- iOS: Stripe iOS SDK

- Web: Stripe JS

- React Native: Stripe React Native SDK

Developers may implement secure and practical payment methods for their users thanks to the features and tools provided by each SDK or library, which are specifically suited to each platform.

Cost

The cost of transactions for credit and debit cards, as well as for online wallets - is 2.9% plus 30 cents per transaction.

Platform safely accepts big payments or regular payments by wire transfers, automated clearing house debit, or ACH credit. For ACH direct debit transactions, Stripe charges 0.8%.

💳 Braintree

A software-as-a-service (SaaS) payment gateway called Braintree enables companies to accept online payments from clients. It was started in 2007, and PayPal bought it in 2013. The two primary products offered by Braintree are Braintree Direct (for accepting payments online) and Braintree Extend (for connecting with partners).

Additionally, there is Braintree Auth, which is still in development as of this writing but will "enable your merchants to connect a Braintree account to your platform, and receive permission to take action on their behalf." There is also Braintree Marketplace, which handles payments for online marketplaces.

Integration

For mobile platforms, PayPal doesn’t have platform-specific SDKs. But you can use Braintree. Here and here you will find more information about it. For web apps you can integrate PayPal JavaScript SDK.

Cost

The standard rate for receiving transactions varies by region and transaction type. On average, this is from 3.40% to 5.40% plus a fixed fee. You can find all other information on the company's official website in the PayPal Merchant Fees section.

💳 Mangopay

MangoPay is a payment provider specialized in providing payment and financial management solutions for platforms, online marketplaces and crowdfunding platforms.

It provides resources for managing accounts, processing payments, making payouts, and conducting other financial activities. Along with enforcing regulatory compliance, MangoPay provides fraud prevention and implements KYC (Know Your Customer) and AML (Anti-Money Laundering).

Integration

Klarna doesn’t provide specific SDKs. Sofort integration with web applications or platforms can be done through the use of APIs.

Cost

Successful transactions made via Sofort cost just €0.11 + from 1% to 2%.

🧐 Comparison Of Popular Payment Gateway Providers for SaaS

Well, there was a lot of different information in today's article. Therefore, we decided to collect it in tables. This will make it easier for you to compare payment providers. We hope this will make your choice easier!

Let's start with the cost and fees of payment providers 👇

🧑💻 How to integrate a Payment Gateway

In this section, we will delve into the process of integrating the payment gateway in more detail. Let's look at integration using the example of one of the largest payment gateways - Stripe.

The Stripe integration tutorial lists seven platforms, but those are only the ones for which there is an official integration. In theory, you can write in any language and platform. Let's look at an example for Node.js.

First, you need to install the official SDK.

If using npm:

📚Case Study

We also want to share with you our experience in integrating payment providers into various applications.

MangoPay was selected as the payment processor for the OvalMoney MVP development in 2016. The architecture of MangoPay made it possible to set up rules for money transfers to users' wallets inside the application and to create user accounts. In-App Purchases were also handled by Stripe, providing users with a streamlined payment process.

The Purchasely platform was incorporated for the Clay app to implement unique Payment Gateways inside the iOS app. This made it possible for marketers to do A/B testing on various discounts, promotions, and payment channels. In-App Purchases were made concurrently using Stripe, which offered a dependable payment method.

Stripe was selected as the payment provider for both the ForceUSA and Art of Comms applications. It was utilized to grant users access to premium content and offer membership services. Stripe's robust features and flexibility ensured a secure and seamless payment experience for users.

Braintree has been selected as the payment service provider for the Feel Amazing app. To make access to premium content easier and provide consumers with subscription alternatives, Braintree was integrated into the app, which has made the payment procedure dependable and easy.

Was it helpful?

Questions you may have

Take a look at how we solve challenges to meet project requirements

What is the importance of selecting the right payment provider for a SaaS product?

The right payment provider is crucial for a SaaS product as it ensures smooth and secure payment processing, improves user experience, and can even boost sales.

What are the potential risks associated with choosing the wrong payment provider?

Choosing the wrong payment provider can lead to data breaches, fraudulent activities, damage to the company's reputation, and revenue loss.

What criteria should be considered when choosing a payment provider for a SaaS product?

When choosing a payment provider for a SaaS product, important criteria to consider include security and compliance measures, available payment options, pricing structure, support for recurring payments, transaction limits, subscription management tools, reporting and analytics capabilities, and compatibility with physical or non-physical goods. Additionally, considering the integration options for different platforms (e.g., web, mobile) is essential.

How does the security and compliance of a payment provider impact the decision-making process?

The security and compliance of a payment provider are crucial factors to ensure the protection of customer data and meet industry standards. It’s important to verify if the provider complies with the Payment Card Industry Data Security Standard (PCI DSS) and has robust security measures in place.

Why is the availability of multiple payment options important for a SaaS product?

Having multiple payment options is important as it caters to a wider range of customer preferences and increases the chances of completing successful transactions. Popular options include major credit and debit cards, digital wallets like PayPal, Apple Pay, and Google Pay.

How does pricing play a role in selecting a payment provider?

Pricing varies among payment providers, so it's important to compare their fees, transaction costs, and any additional charges to ensure they fit within your budget. Consider the expected transaction volume and any potential discounts for high-volume businesses.

Read also

How to Build SaaS App Like Spotify

What makes React the best option for SaaS Apps?

Why SaaS is Benefitial for Small and Medium-sized Businesses?

How to Leverage the ChatGPT API in Your SaaS Products?

How to Monetize Your SaaS Product: Pricing Models and Strategies for Success

How To Choose and Integrate a Mobile App Payment Gateway?

Our clients say

![Stormotion client David Lesser, CEO from [object Object]](/static/93e047dadd367691c604d8ffd1f54b58/b0e74/david.png)

They were a delight to work with. And they delivered the product we wanted. Stormotion fostered an enjoyable work atmosphere and focused on delivering a bug-free solution.

David Lesser, CEO

Numina